Recent Articles from Adaptrade Software

Robust Optimization for Strategy Building

Optimization has had a role in trading strategy development for as long as I've been involved in trading — roughly thirty years now. Even among traders who claim to never optimize, their strategies often consist of indicators, parameter values, stop sizes, and other features that they've found through practical experience work best. That itself is a form of optimization. However, while the presence of optimization has been a constant for all that time, the methods of optimization have evolved.

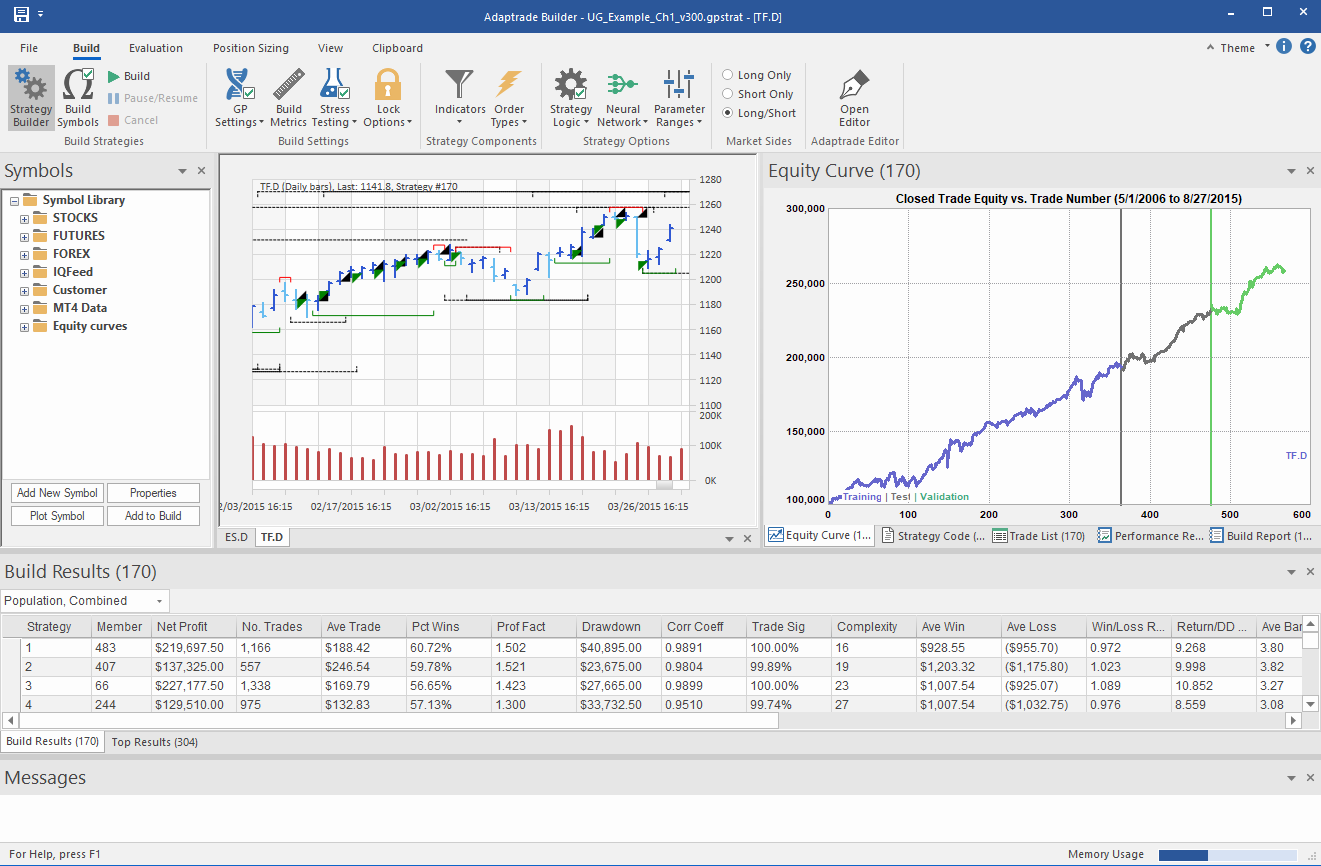

In this article, I'll propose a relatively simple approach to optimization that runs counter to the prevailing pedagogy but which I believe may be preferable to more complicated methods that are currently taught. I'll first present a brief history of optimization in strategy development over the past thirty years from my personal perspective. I'll then argue that the lessons learned over that time make it feasible to use a comparatively simple optimization approach without incurring the drawbacks encountered in the past. I'll outline my proposed method and close with an example employing my trading strategy generator, Adaptrade Builder.

Trading Strategy Optimization Then and Now

When I first started developing trading strategies in the early 90's, optimization was primarily applied to existing trading strategies to optimize their parameter values — indicator look-back lengths, oscillator levels, stop sizes, and so on. Optimization was a controversial topic, and the statistical concept of over-fitting was often described inaccurately as "curve-fitting".1, 2 In many cases, optimizations were performed on all available data, without leaving aside data for out-of-sample testing. Many of the best practices strategy developers and traders utilize today didn't exist at that time.

It's now widely understood that it's not curve-fitting per se that's problematic but over-fitting. Curve-fitting is just another name for optimization. Over-fitting, on the other hand, occurs when the optimization process fits the strategy to the market's noise, rather than just the signal. The signal is the part of the market that contains predictive information, whereas the noise is random. If the strategy fits too much of the noise, it may look good in hindsight but have little predictive power.