Fixed Ratio Position Sizing

Market System Analyzer (MSA) is a trading software application that includes fixed ratio position sizing. Market System Analyzer is designed to improve the performance of existing trading systems and methods by enabling the trader to explore different position sizing methods, optimize trade sizes, and analyze their trading using methods such as Monte Carlo analysis and significance testing.

In fixed ratio position sizing, developed by Ryan Jones ("The Trading Game," by Ryan Jones, John Wiley & Sons, New York, 1999), the key parameter is the delta. This is the dollar amount of profit per share/contract to increase the number of shares/contracts by one. A delta of $3,000, for example, means that if you're currently trading one contract, you need to increase your account equity by $3,000 to start trading two contracts. Once you get to two contracts, you need an additional profit of $6,000 to start trading three contracts. At three contracts, you would need an additional profit of $9,000 to start trading four contracts, and so on.

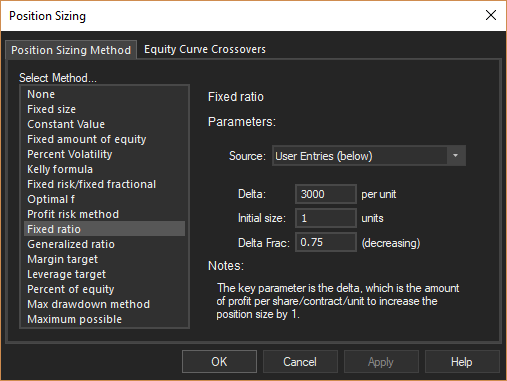

In Market System Analyzer, fixed ratio position sizing is selected from the choices on the Position Sizing Method tab of the Position Sizing window.

Fixed ratio position sizing is selected on the Position Sizing window.

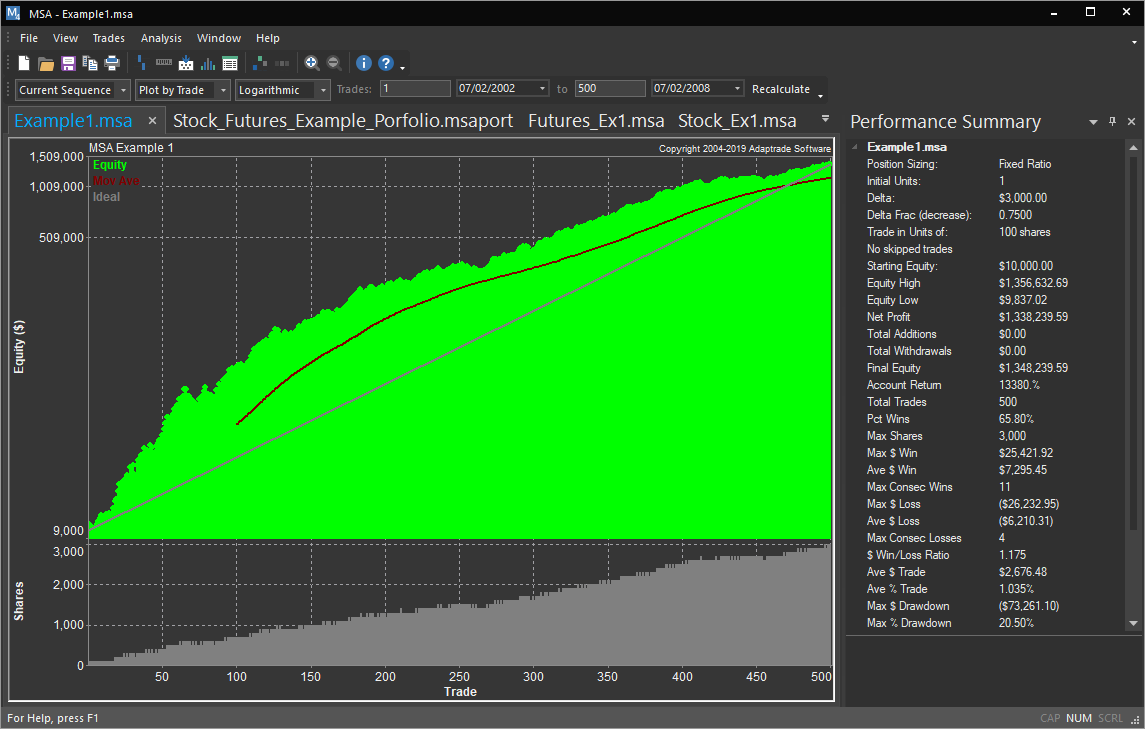

Once the fixed ratio method is chosen, the main chart in Market System Analyzer is automatically updated to reflect the position sizing. The main chart displays the equity curve generated from the user's trade history with the chosen position sizing method. An example is shown below.

Main window of Market System Analyzer showing fixed ratio position sizing.

The initial position size (when the accumulated profits are zero) can also be selected in MSA. The delta fraction determines the delta for decreasing the position size. The delta fraction is multiplied by the original delta to calculate the decreasing delta. The delta fraction is set to the value 1.0 by default, which implies the two deltas will be the same.

If a delta fraction less than 1.0 is entered, the levels of increase and decrease will be closer together, which will cause the position size to decrease more frequently in drawdowns as the equity drops. This will provide more protection from drawdowns but less ability to recover. If a delta fraction greater than 1.0 is entered, the level of decrease will be farther from the level of increase, so the position size will not drop as quickly or change as often during a drawdown. This will provide less protection during drawdowns but make it easier to recover.

To learn more about Market System Analyzer (MSA), click here.

To learn how to optimize position sizing methods in MSA, click here.