Recent Articles from Adaptrade Software

Deep Neural Networks for Price Prediction, Part 1

Ever since a deep convolutional neural network set a new record in the ImageNet image classification contest back in 2012,1 deep neural networks have revolutionized the field of artificial intelligence. Now, of course, almost everyone is familiar with large languarge models (LLMs), such as ChatGPT, which are based on deep neural networks. However, far less attention has been paid to the use of similar technologies for predicting financial market prices.

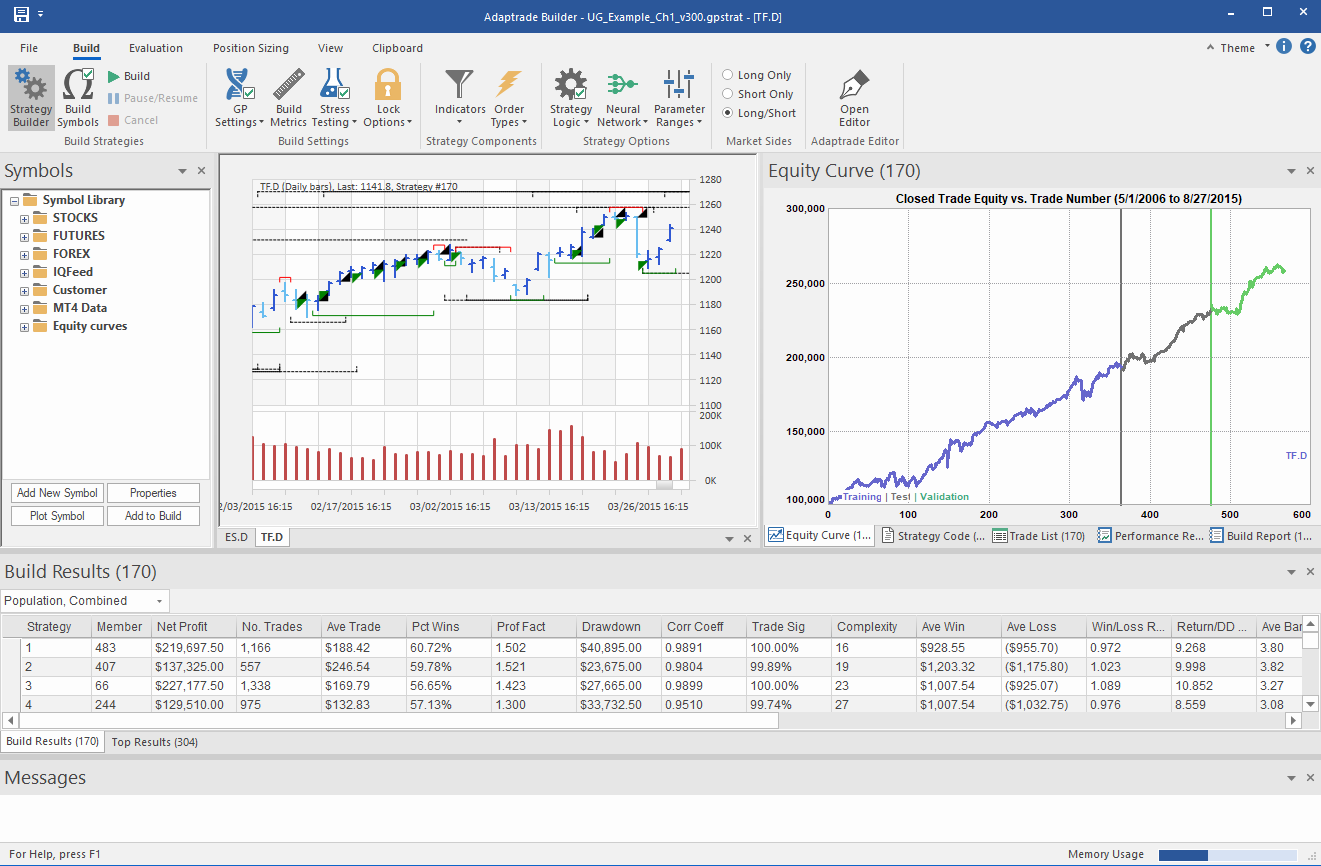

With this article and the next one, I'll preview a new feature I've been working on for my trading strategy generator, Adaptrade Builder, that allows the user to train and use a deep neural network for predicting market prices. In this article, I'll cover the basic concepts involved and illustrate the potential of deep neural networks by training several networks on different price series. In the next article (Part 2), I'll show how these networks can be used as part of a trading strategy.

Why Deep Neural Networks?

Developing a systematic trading strategy is about finding an edge in the market and turning that into code. Oftentimes, that means finding some mix of indicators and price patterns that when used in combination with specific entry and exit orders results in an overall net profit in out-of-sample testing. Strictly speaking, a trading strategy is not about predicting future prices. In fact, even with less than 50% winners — sometimes much less — a strategy can still be profitable if it has a high win/loss ratio. Nonetheless, if we had a way to predict the next day's price (or the price in two days, next week, etc.) with any reasonable accuracy, that would certainly be an advantage.

That's where deep neural networks (DNNs) come in. DNNs are powerful general-purpose function approximators, which gives them an advantage over older machine learning methods and other, simpler techniques that have been used to predict market prices. By adding more "nodes" to the neural network, a DNN can be made as complex as needed to capture the market's essential dynamics. And unlike traditional systematic trading methods, neural networks are less likely to overfit the training data, even when there are many more parameters (i.e., weights) than data points.